Chairman’s statement

The record order book gives Cohort visibility out to the next decade. Along with our strong net funds and market position this provides a solid foundation for future organic growth as well as the ability to make further strategic additions to the Group.

Highlights presentation video

Financial highlights FY2023/24

Adjusted* operating profit (£m)

Order intake (£m)

Net funds (£m)

Revenue (£m)

* Adjusted figures exclude the effects of marking forward exchange contracts to market value, other exchange gains and losses and amortisation of other intangible assets.

Operational highlights FY2023/24

- Record revenue, adjusted operating profit, order intake, closing order book and net funds. Adjusted operating profit of £21.1m (2023: £19.1m) on revenue of £202.5m (2023: £182.7m).

- Order intake of £392.1m (2023: £220.9m), including the £135m Royal Navy contract awarded to SEA in March 2024.

- Dividend increased by 10%. The dividend has been increased every year since the Group's IPO in 2006.

- Net funds above market expectations at £23.1m (2023: £15.6m).

- Sensors and Effectors saw robust growth, with Chess and SEA delivering improved performances. Communications and intelligence reported a weaker year overall.

- Order book exceeded half a billion pounds for the first time, with deliveries now extending out to 2037.

Measuring our progress

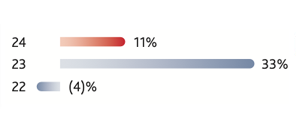

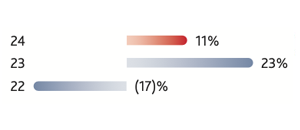

Indicates the change in total Group revenue compared with prior years.

Why is it important?

Revenue growth gives a quantified indication of the rate at which the Group’s business activity is expanding over time.

Results

11%

Comment on results

The Group revenue was up on last year, increasing from £182.7m to £202.5m with strong contribution from the Sensors and Effectors division.

Change in Group operating profit before exceptional items, amortisation of other intangible assets, research and development expenditure credits and non-trading exchange differences, including marking forward exchange contracts to market.

Why is it important?

The adjusted operating profit trend more accurately captures the business’ contribution to shareholder value than a pure cash measure. It is also an indication of whether additional revenue is being gained without profit margins being compromised.

Results

11%

Comment on results

On the back of the higher revenue, the trading result of the Group improved by a similar level.

Orders for the next financial year expected to be delivered as revenue, presented as a percentage of market revenue forecasts for the year as at 30 April 2024.

Why is it important?

Order book visibility, based on expected revenue during the year to come, provides a measure of confidence in the likelihood of achievement of future forecasts.

Results

92%

Comment on results

This is a further improvement on the last three years, reflecting the continuing progress in the size and longevity of the order book, with orders now stretching out to 2037 (2023: 2032). The order book cover for 2024/25 had further increased to over 95% by mid-July 2024.

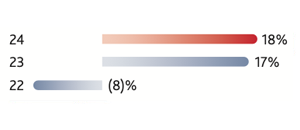

Annual change in earnings per share, before exceptional items, amortisation of other intangible assets and non-trading exchange differences including marking forward exchange contracts to market, all net of tax.

Why is it important?

Change in adjusted earnings per share is an absolute measure of the Group’s return to shareholders (net of tax and interest).

Results

18%

Comment on results

The 18% increase compares to an 11% increase in the adjusted operating profit, reflecting a lower tax rate due to overseas R&D tax credits, including R&D.

Net cash generated from operations (net of interest and net capital expenditure) before tax as compared to the profit before tax and interest, excluding amortisation of other intangible assets over a rolling four-year period.

Why is it important?

Operating cash conversion measures the ability of the Group to convert profit into cash.

Results

98%

Comment on results

The conversion in the last year improves a high conversion ratio of the last two years and was as a result of strong cash control in the Sensors and Effectors division. We expect the cash conversion in the coming year to decline slightly as the capital expenditure at ELAC SONAR for its new facility reaches a peak.

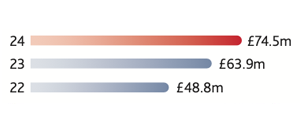

Total sales to markets outside the UK, Germany and Portugal.

Why is it important?

International markets are important to the organic growth of the business and reduce our dependence on domestic markets.

Results

£74.5m

Comment on results

The increase in 2024 export revenue is driven by higher export sales in Sensors and Effectors, especially for naval customers of SEA.

DOwnload full report

Annual Report 2024

August 2024